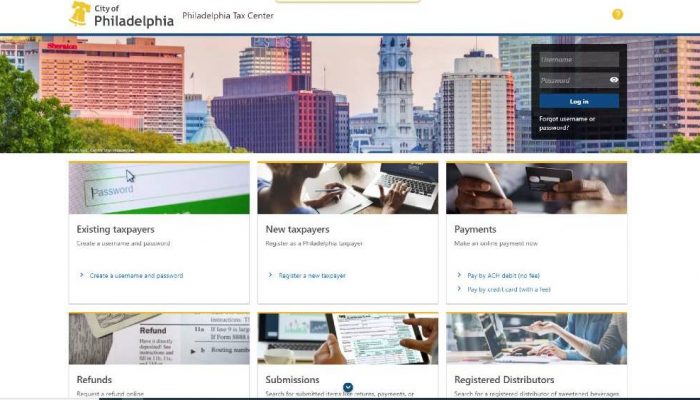

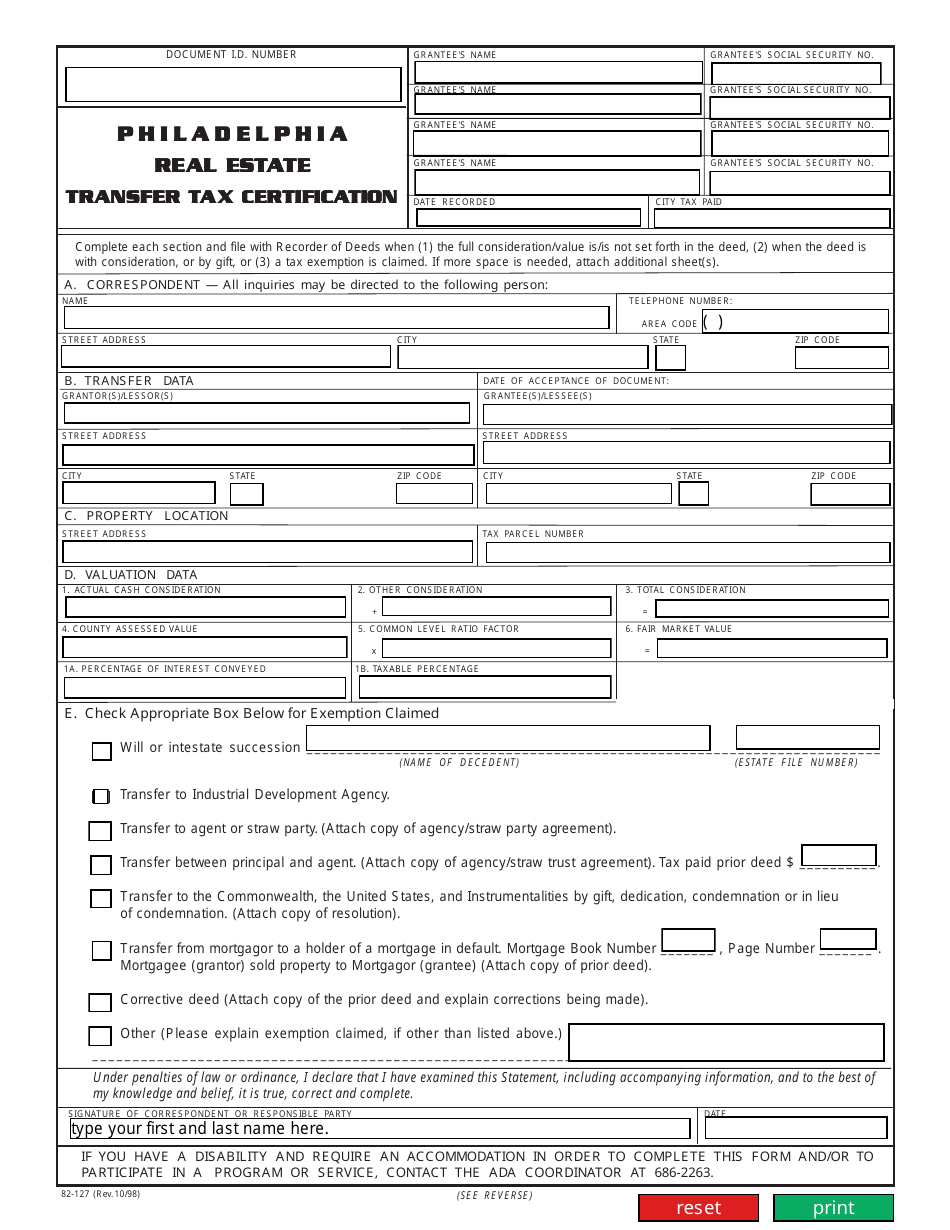

philadelphia transfer tax form

Instructions for completing philadelphia real estate transfer tax certification Section A Correspondent. Regulations rulings tax policy.

Pa Local Earned Income Tax Return Fill Out Tax Template Online Us Legal Forms

We use cookies to improve security personalize the user experience enhance our marketing.

. If you are selling or transferring your business you must file a Change Form in order to cancel your tax liability with the City. Download Or Email Form 82-127 More Fillable Forms Register and Subscribe Now. If more space is needed attach additional sheets.

2 X 100000 2000. Interest penalties and fees. Ad Download Or Email Form 82-127 More Fillable Forms Try for Free Now.

Technical private letter rulings. Philadelphia PA 19102 215 686-6442 Real Estate revenuephilagov 215 686-6600 Taxes. Follow the step-by-step instructions below to design your philadelphia transfer tax form.

A typed drawn or uploaded signature. 3278 City 1 Commonwealth 4278 Total The tax rate is based on the sale price or assessed value of the property plus any assumed debt. Get the free philadelphia realty transfer tax form 2011-2022 Get Form Show details Hide details A statewide list of the factors is available at the Recorder of Deeds office in each county.

Instructions for completing philadelphia real estate transfer tax certification Section A Correspondent. REV-183 -- Realty Transfer Tax Statement of Value REV-618 -- Brochure. The City of Philadelphia imposes a Realty Transfer Tax on the sale or transfer of real property located in Philadelphia.

Effective october 1 2018 the transfer tax for the city of philadelphia is 3278 with an additional state of pennsylvania tax of 1 for a total of 4278. The State of Pennsylvania charges 1 of the sales price and the municipality and school district USUALLY charge 1 between them for a total of 2 ie. Publications forms 2021 Realty Transfer Tax collection 2021 Realty Transfer Tax collection The City of Philadelphia imposes a Realty Transfer Tax on the sale or transfer of real property located in Philadelphia.

Enter the date on which the deed or. Complete each section and file in duplicate with Recorder of Deeds when 1 the full considerationvalue isis not set forth in the deed 2 when the deed is with consideration or by gift or 3 a tax exemption is claimed. Make an appointment for City taxes or a water bill in person.

Philadelphia Beverage Tax. If no sales price exists the tax is calculated using a formula based on the property value determined by the Office of Property Assessment OPA. The Guide of finalizing Philadelphia Real Estate Transfer Tax Certification - City Of Philadelphia Online.

CocoDoc is the best platform for you to go offering you a marvellous and easy to edit version of Philadelphia Real Estate Transfer Tax Bcertificationb as you require. Enter the name address and telephone number of party completing this form. There are three variants.

Philadelphia transfer tax form real estate. Enter the name address and telephone number of party completing this form. These documents contain the full regulations for the Realty Transfer Tax as well as clarifications from technical staff on how the Department of Revenue interprets the law.

Bureau of individual taxes po box 280603. Section B Transfer Data. 2 x 100000 2000.

How to file and pay City taxes. Sales Use. Section B Transfer Data.

Create your signature and click Ok. Electronic funds transfer EFT Modernized e-Filing MeF for City taxes. Failure to complete this form properly or attach requested documentation may result in the recorders refusal to record the deed.

You can also update your information online but must create a username and password first. If no sales price exists the tax is calculated using a formula based on the property value determined. Hit the Get Form Button on this page.

Select the document you want to sign and click Upload. Tobacco and Tobacco-Related Products Tax. If no sales price exists the tax is calculated using a formula based on the property value determined by the Office of Property Assessment OPA.

Enter the date on which the deed or. The current rates for the Realty Transfer Tax are. If you take an interest in Fill and create a Philadelphia Real Estate Transfer Tax Certification - City Of Philadelphia heare are the steps you need to follow.

Transfer form 01t instructions - utah transfer on death deed form. 3278 City 1 Commonwealth 4278 Total The tax rate is based on the sale price or assessed value of the property plus any assumed debt. If you need to update your address close a tax account or request payment coupons you can use the Department of Revenues change form.

Tax forms instructions. Business Taxes Business Income Receipts Tax Business Income Receipts Tax BIRT No Tax Liability forms. PA Realty Transfer Tax and New Home Construction REV-715 -- Realty Transfer Tax Monthly Report REV-1651 -- Application for Refund PA Realty Transfer Tax REV-1728 -- Realty Transfer Tax Declaration of Acquisition Revenue Code Chapter 91 -- Revenue Code - Chp 91.

Are you thinking about getting Philadelphia Real Estate Transfer Tax Bcertificationb to fill. Decide on what kind of signature to create. These documents contain data on the monthly collections of the Realty Transfer Tax in 2021.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Instructions for completing realty transfer tax statement of value this statement must be signed by a responsible person connected with the transaction. Think of the transfer tax or tax stamp as a sales tax on real estate.

THIS STATEMENT MUST BE SIGNED BY A RESPONSIBLE PERSON CONNECTED WITH THE TRANSACTION. The current rates for the Realty Transfer Tax are. The new owner must apply for a new Tax Account Number and a new Business privilege License.

Pay delinquent tax balances. Stay away from spending unneeded time use only up-to-date and accurate form templates by US Legal Forms experts. Look up your property tax balance.

Sell or transfer a business. Philadelphia Pennsylvania Realty Transfer Tax Statement of Consideration Download the form youre searching for from your website library.

Member To Member Transfer Philadelphia Federal Credit Union

Philadelphia Launches New City Tax Site Brinker Simpson

Log In To The Philadelphia Tax Center Today Department Of Revenue City Of Philadelphia

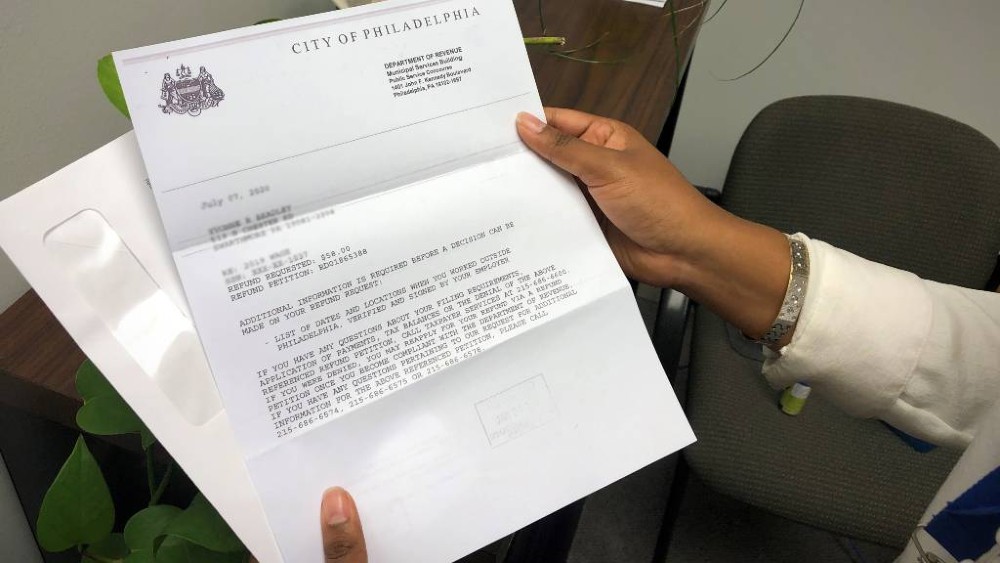

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

Minnesota Department Of Revenue Minneapolis Mn Mm Financial Consulting Minneapolis Lettering Letter I

Philadelphia County Gift Deed Form Pennsylvania Deeds Com

Philadelphia Subpoena Form Form Ead Faveni Edu Br

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

Coronavirus Bulletin Board Aids Law Project

Philadelphia County Gift Deed Form Pennsylvania Deeds Com

Philadelphia County Quit Claim Deed Form Pennsylvania Deeds Com

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

How To Get An Extension To File Your Philadelphia Business Taxes By July 15 Department Of Revenue City Of Philadelphia

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

United Bank Of Philadelphia Review Black Owned Low Minimum Deposits

100 Legit Track Mtcn Before Payment Contcat Us For Your Own Mtcn Today Get Western Western Union Money Transfer Western Union Money Market Account

Check The Po Box Mailing Tax Payments Forms To Revenue Department Of Revenue City Of Philadelphia

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Philadelphia Neufchatel Cheese With 1 3 Less Fat Than Cream Cheese 8 Oz Brick Walmart Com